|

This information is from Bright. The underlying data we used is here. If you want more information about Narberth and Lower Merion, or any other local real estate, please reach out to Ed or Cindy Ridgway.

If you were wondering what a million+ bought you in Narberth in 2021, take a look below. Plus - here are a few interesting facts: Nine homes sold for over $1M last year. Most sold for over asking price, and one sold for more than 30% over the listed price! Newly constructed and fully renovated homes commanded a real premium, and the most expensive went for went for $1.45 million!

When Main Line Parent took a look at family-friendly neighborhoods, it was only natural that Narberth was featured among them. And when it comes to Narberth neighborhoods, it was only natural that Cindy Ridgway helped to tell the story! See the Neighborhood Guide to Narberth.

This Narberth photo is from Don Groff. The early start of the Spring market has seen some of the most intense competition for homes this region has ever experienced. The combination of low inventory, low interest rates, and pent-up demand from a pandemic-interrupted 2020, created the perfect storm for a seller’s market.

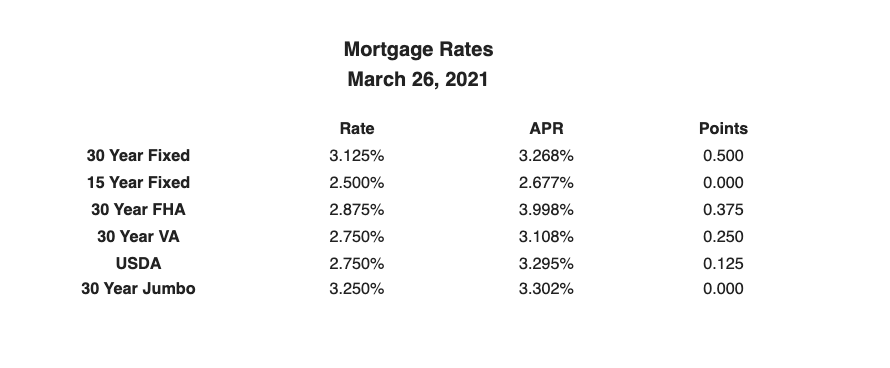

Here are 10 updates from the local real estate scene: Spring came early. The Spring market is a “thing” because families want to buy in the Spring, and move in the summer, so they are settled before the new school year in the fall. The 2021 market started warming up well ahead of the weather outside - it was already well underway before Superbowl Sunday this year! There are way more buyers than sellers right now. Homes for sale, especially those listed by experienced realtors, are attracting unusual levels of buyer traffic. With Covid safety measures making it important for parties to distance from each other, it’s become common for available showing appointments to be booked up for days in a row, and for a (distanced) line of prospective buyers waiting for their turn to enter an open house. Many homes are selling for over the asking price. Often, the list price is just the starting point for negotiations. Sale prices are often much higher, and can substantially exceed appraised values. Cash offers have become much more common. As sellers are looking for certainty and finality, a cash or “no mortgage contingency” offer is viewed as stronger and “cleaner” than an offer with a mortgage contingency. For this reason, at lower price points, prospective homeowners often lose bidding wars to investors looking for properties to rent or flip. Appraisals are still catching up with sale prices. The publicly-available data doesn’t tell the whole market value story because the MLS doesn’t show the final price of homes sales that haven’t closed yet. Now more than ever, it’s important to have an agent who is an expert in the neighborhoods you’re targeting. The best agents have been in all the recently sold homes, and they can best estimate what a house “should” go for. Unrepresented buyers and sellers are at a disadvantage. As the seller typically pays the agent’s commissions, there's almost never a good reason to be an unrepresented buyer. It’s like turning down a good free lawyer on your day in court, and just hoping for the best! Plus, some properties are actually under contract by the time an unrepresented buyer sees them on syndicated websites like Zillow. Sellers need agents more than ever, too, because the “market price” for homes is changing so fast. FSBO sellers, trying to save on commissions, can end up netting less on the sale because they don’t know how to handle multiple offers, and because they don’t have an agent’s insight about local market changes that month, that week, or even that day. Agents who are experts in your neighborhood are worth every penny, and then some. Some winning buyers are dropping contingencies. Contingencies are the “unless” clauses that give buyers a contractual right to back out of an agreement. For years, in our local market, it has become commonplace for strong offers to be free of home sale contingencies - that is, the offer to buy the new house is not contingent on the sale of the buyer’s old house. Now, in this ultra-competitive 2021 market, agents are helping clients with creative strategies to win bidding wars. Some buyers are dropping all contingencies to win homes, including inspection contingencies! Contingencies protect the buyer’s deposit money, so make sure you understand the implications before you waive them. Some of the higher price points are the most competitive. While all budget levels are popular right now, recently we’ve seen some of the fiercest competition for houses $1M+ that we’ve seen in years. “Done” and “new” command a real premium. People move to the neighborhoods in and around the Lower Merion School District for the schools, walkability, and easy commutes, and they usually just accept the fact that the local home inventory is mostly older. In the few cases where this great location is combined with new construction, those homes command a high premium. Buyers are likewise choosing to pay a premium for homes that have been renovated with new kitchens and bathrooms, luxurious bedroom suites, or finished basements. With interest rates so low, buyers are choosing a bigger mortgage over the inconvenience of living through a project. Interest rates are still near historic lows, but have recently started to creep back up. One of our lenders, Tim Lowry, of Prosperity Mortgage, gave us the following March 26 interest rate update. See their website for details or email Tim. |

Categories

All

|

- Home

- Contact

- Testimonials

-

Listings

- 5 Hempstead Rd

- 323 Grayling Ave

- 114 Merion Ave

- 207-209 Wayne Ave

- 511 Kenilworth Rd

- 509 Kenilworth Rd

- 525 Broad Acres Rd

- 115 Winchester Rd

- 115 Glenwood Rd

- 139 Powell Rd

- 249 Iona Ave

- Merion Station 2023

-

Previous Listings

>

- 637 S. Bowman

- 40 Derwen Rd

- 233 Marlboro Rd

- 932 Clover Hill

- 504 Brookhurst

- 2729 Oakford Rd

- 222 E Montgomery

- 320 Winding Way

- 208 Jefferson Rd

- 401 Baird

- 123 Glenwood

- 127 Chestnut

- 53 Schiller Ave

- 101 Conway Ave

- 314 Grayling Ave

- 29 Hansen Court

- 311 Gypsy Ln

- 8 Brynwood Manor

- 507 Baird Rd

- 223 Valley Rd

- 17 Shirley Road, Narberth

- 3 Narwyn Ln, Narberth

- 405 Merwyn Rd

- 208 Woodbine Ave, Narberth

- 225 Marlboro Rd, Ardmore

- 112 Elmwood Ave

- 262 Barwynne Rd

- 526 Dudley Ave

- 120 Merbrook lane

- 219 Conway Ave

- 19 Woodside

- 105 Price Ave

- 225 Iona

- 381 E. Montgomery

- 503 Valley View

- 509 Monroe

- 123 Elmwood

- 157 Merion

- 9 Chestnut

- 311 Gypsy Lane

- 225 Price

- More

4 E. Montgomery Ave, Ardmore, PA 19003

610.822.3356 (office)

610.822.3356 (office)

site search:

Want to get a copy of our monthly newsletter with Narberth and Lower Merion news and events? Sign up here.