|

We're lucky to have a few great little downtowns in our area, and one of our favorites is having a big weekend. Bring the whole family, and enjoy the nice Spring weather at some of these outdoor events this weekend in the Borough: Thursday, May 2 Narberth Farmers Market Narberth's first market of the 2024 season! The market is in Narberth's Station Circle every Thursday this summer, from 3-7pm. Friday, May 3 First Friday in Narberth Meet your friends and neighbors in downtown Narberth for a bite or a beverage, and enjoy art and live music all over town. Several shops are open late. The girl scouts even have babysitting available at Borough Hall, so you can turn it into a "date night"! Details here. Friday May 3 NarbArt Month Kickoff NarbART Month is an annual showcase of creativity through public art. Local artists partner with business owners to design and create original artworks around a common theme. Art can be seen in shop windows, vacant storefronts and public spaces across Narberth. Special sales and promotions are offered at participating businesses. Details here. Saturday, May 4 - Noon to 4pm NarbEarth Day This year marks the 35th edition of this popular event in Narberth Park. The Narberth Civic Association invites everyone to join them for a day of music, crafts, food, and activities highlighting the preservation of the environment. There will be animals, gardening info, a plant swap, and more. Details here. Saturday & Sunday, May 4-5

Bingo, seed planting, and Plant starter sale This new local business will be setting up shop at the GET Cafe all weekend. More details here.

0 Comments

Valentine's Day is a great opportunity to support some of your favorite local businesses. Make a reservation now at that restaurant you love (or always wanted to try) before it gets sold out. Look for ways to buy from your local independent stores before you turn to Amazon and 1-800 Flowers! Here are a few ideas to get you started. We’ll keep adding to this list as we find more. Feel free to let us know if you have some good ideas that need to be included. Sweets

Savory

Flowers and More

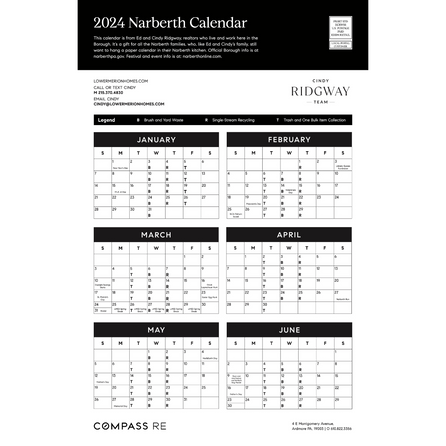

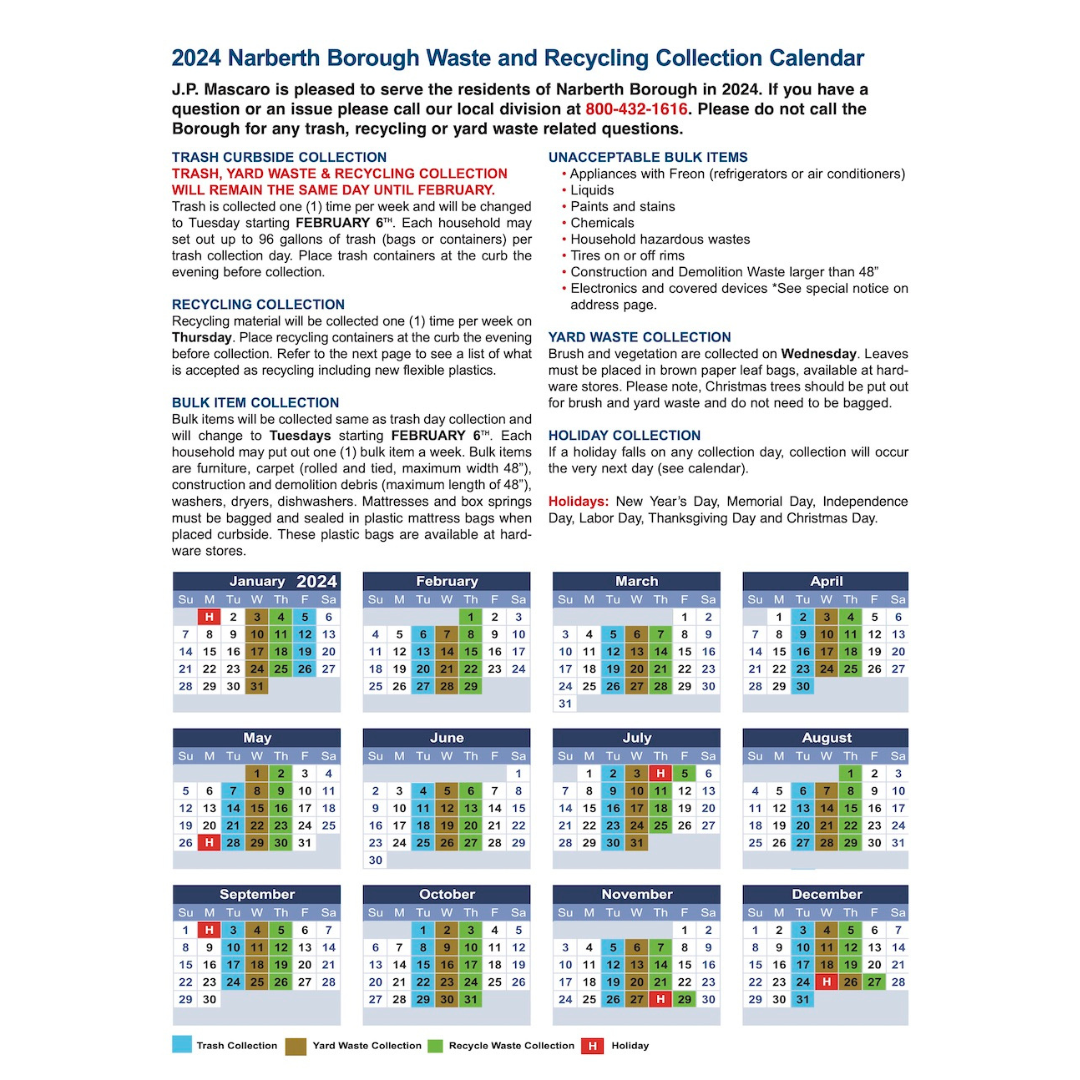

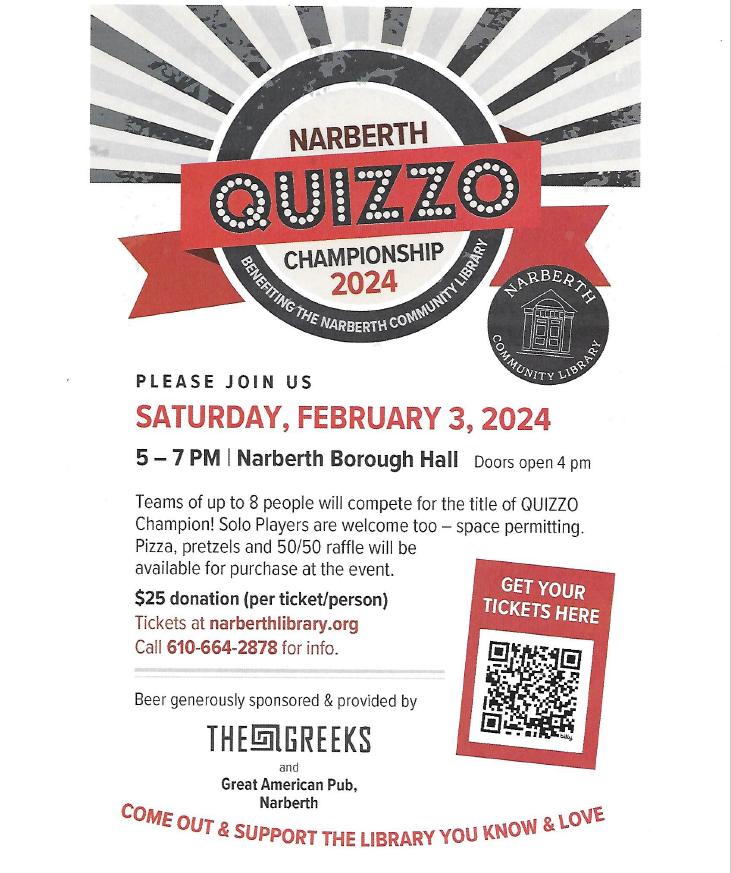

Lower Merion and Narberth - Stuff you should know New Year 2024 Edition! We get all sorts of different questions about Lower Merion and Narberth, so we put together a few quick items of interest every month or so. If you have a friend who needs this info emailed to them, have them use this link Christmas Tree Collection Lower Merion Township will begin the collection of trees (which must be placed curbside) during the first two weeks in January, on your regular refuse collection day. Residents may also dispose of Christmas trees at the Public Works Complex located at 1300 N Woodbine Avenue in Penn Valley, Monday through Friday 8am-3pm and Saturday 9am-2:30pm. All ornaments, stands and other decorations must be removed. Narberth residents can put their Christmas trees on the curb on Tuesdays nights in January. They will be collected with the regular Wednesday brush pickups in January. All ornaments, stands and other decorations must be removed. Remember to bring reusable bags! Narberth and Lower Merion both have ordinances restricting the use of plastic bags by stores. LM’s new ordinance goes into effect on January 21. LM trash holiday schedule In Lower Merion, a refuse and recycling holiday collection schedule will be in effect for January 1st through 5th, due to the New Year's Day holiday and also January 15th through 19th, due to the Martin Luther King, Jr. holiday. There will be no refuse or recycling collection on Monday, January 1 or Monday, January 15. More info here: Narberth Trash/Recycle Changes Narberth's new trash and recycling company, J.P. Mascaro, has already started pickups on the old schedule. Starting on February 6, the new schedule moves trash and bulk pickup from Fridays to Tuesdays. Brush is still Wednesdays, and recycling is still Thursdays. More details here. Narberth now recycles more items Borough residents can add more (unbagged) items to their recycling bins for Thursday collections. More details here. That's a lot of trash info! Sometimes it's tough for residents to keep up with all the trash and recycling rules and schedules, which is why we include so much in these updates. We also keep a trash & recycling info web page updated with everything LM and Narberth residents need to know. And lastly, a couple of non-trash items to mention: The Borough has a new Manager Matt West was the Borough's director of technology and Assistant Manager a few years back and recently served as Interim Manager. Now he has been appointed as Narberth's Borough Manager. Say hello next time you're in Borough Hall! Quizzo Championship - February 3

Teams of up to eight are encouraged to register to compete in this annual Quizzo battle to raise money for the Narberth Community Library. Cindy and Ed plan to take the trophy home with us, but those who wish to compete for second place can register and get more info here. Have a friend who needs this local info each month? Use this link to add an email to our list. |

Categories

All

|

- Home

- Contact

- Testimonials

-

Listings

- 323 Grayling Ave

- 114 Merion Ave

- 207-209 Wayne Ave

- 511 Kenilworth Rd

- 509 Kenilworth Rd

- 525 Broad Acres Rd

- 115 Winchester Rd

- 115 Glenwood Rd

- 139 Powell Rd

- 249 Iona Ave

- Merion Station 2023

-

Previous Listings

>

- 637 S. Bowman

- 40 Derwen Rd

- 233 Marlboro Rd

- 932 Clover Hill

- 504 Brookhurst

- 2729 Oakford Rd

- 222 E Montgomery

- 320 Winding Way

- 208 Jefferson Rd

- 401 Baird

- 123 Glenwood

- 127 Chestnut

- 53 Schiller Ave

- 101 Conway Ave

- 314 Grayling Ave

- 29 Hansen Court

- 311 Gypsy Ln

- 8 Brynwood Manor

- 507 Baird Rd

- 223 Valley Rd

- 17 Shirley Road, Narberth

- 3 Narwyn Ln, Narberth

- 405 Merwyn Rd

- 208 Woodbine Ave, Narberth

- 225 Marlboro Rd, Ardmore

- 112 Elmwood Ave

- 262 Barwynne Rd

- 526 Dudley Ave

- 120 Merbrook lane

- 219 Conway Ave

- 19 Woodside

- 105 Price Ave

- 225 Iona

- 381 E. Montgomery

- 503 Valley View

- 509 Monroe

- 123 Elmwood

- 157 Merion

- 9 Chestnut

- 311 Gypsy Lane

- 225 Price

- More

4 E. Montgomery Ave, Ardmore, PA 19003

610.822.3356 (office)

610.822.3356 (office)

site search:

Want to get a copy of our monthly newsletter with Narberth and Lower Merion news and events? Sign up here.